SplashDev Risk Management

The SplashDev Risk Management (SplashRisk) module is an extension for Microsoft Dynamics Business Central (on Premise and Cloud). With SplashRisk you can mitigate the risk with your clients, before giving them a loan or lease. Before providing your client with an offer, you can run a risk assessment on the company or person and validate the credit rating before signing an agreement.

Data Collection

One of the benefits of using SplashRisk include improved data collection and analysis, easier budgeting, greater visibility into severe risks, better communication between stakeholders and compliance teams, and more efficient risk profiles for vendors and third parties.

Risk Management

SplashRisk is a software solution that helps companies to manage their risks, especially in the areas of security, operation, or compliance. It uses data or projections to analyze and prioritize risks, suggest mitigation strategies, and develop remediation processes. Risk management software allows companies to enter, discuss, and evaluate risks and link them to their objectives or goals.

Risk Reduce

SplashRisk provides the framework to reduce the risk of negative outcomes from business relationships or contracts. By streamlining corporate governance into a single system and automating processes, you're able to be proactive in mitigating risk which enables growth strategies.

Simplified Financing Workflow

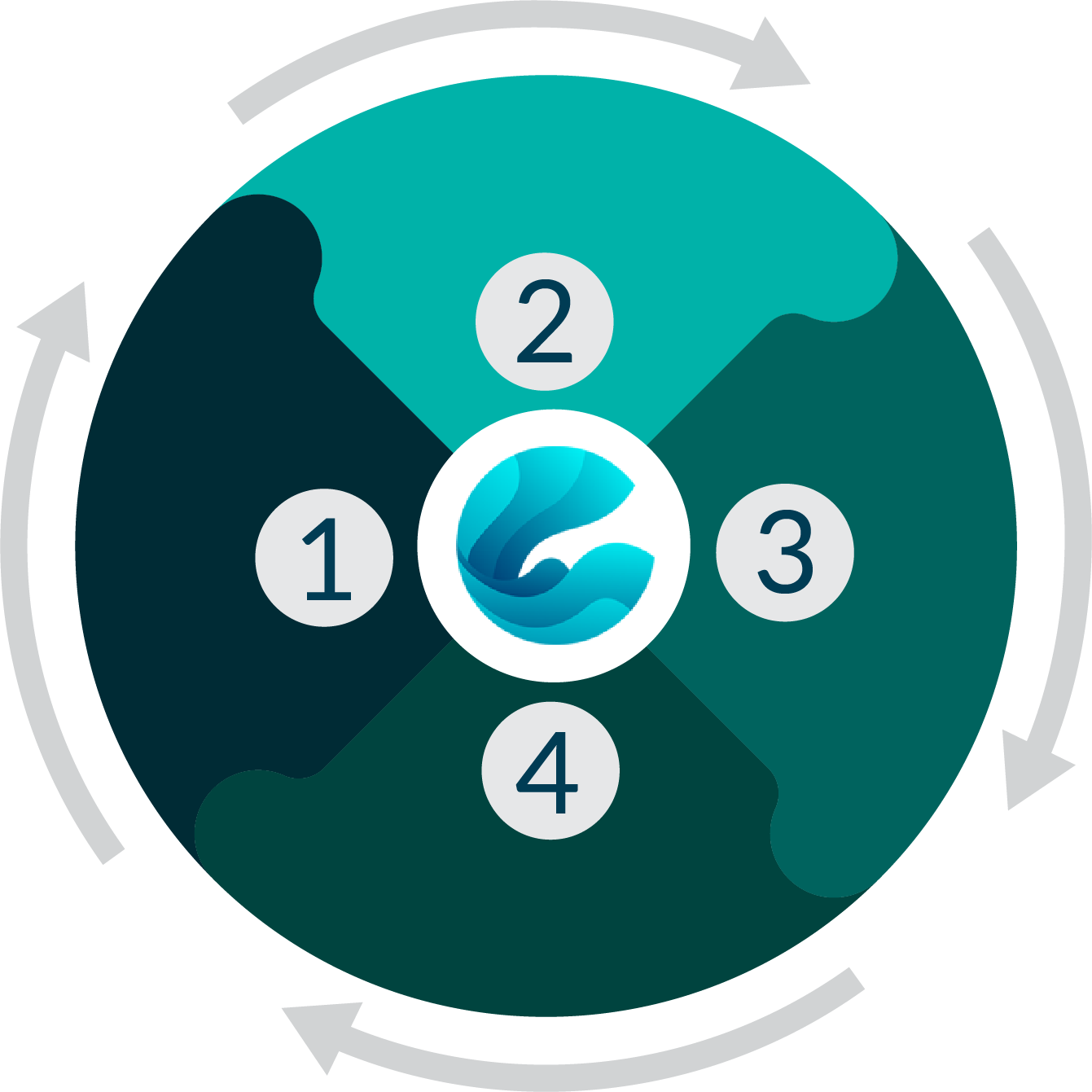

The Simplified Financing Workflow is an easy to understand and customizable workflow that be be adjusted to your specific needs. This flow has several different filters within a single interface. Every step within the flow has checks and values. Filters are available to filter for example on maximum offer value for this customer, financing value, exposures, the number of active contracts with this customer, and more.

The flow contains 4 different stages and is currently available to check the credit rating for companies only.

Stage 1

Gathering all the data required to obtain an approval for an order. This stage uses different webservices to gather information about the customer from different external providers.

It gathers all the information about the company to see if they are for example a startup, a company without any activity or the turnover for the last fiscal year. Company Relations is another webservice where we can find the actual owners of the companies, this information is relevant for the PEP screening and embargo checks.

Stage 2

In this stage we review the gathered data to see if the offer can go further with the analysis in the simplified workflow or not, or if a further check in the extended analysis is required.

Stage 4

In this stage we are reviewing the data we have obtained so far and we will check if an offer can be approved or not. If your customer passed all the checks, an agreement can be generated automatically within the same system.

If the offer was not approved at this point, the customer will move into the extended analysis phase.

Every customer will obtain its own risk file including the results of the analysis and company structures and can be saved for further use.

SplashRisk has a built-in track system where the user can see in real time in which phase of the risk process the request is. All approved and declined steps are visible during the entire process.

The total run-time for the Simplified Risk Process is a matter of minutes. No more long waiting time to obtain a risk assessment but get the results directly during your conversation with your customer.

Stage 3

In stage 3 we gather the information required to come to a final answer to see if a credit or lease can be given to this customer. Based in the company information we obtained about its payment behavior, a rating is given to this company.

The so-called W(R) rating. Based on the relationship information, we built a visible relationship of the ownership of each company. There are no limitations on the depth of this ownership level. With our click through model, you can dive deep into the company structure to assure that this customer caries no risk.

Company Group is being used to calculate the group exposure for the creditor. The exposure calculation flow is connected to for example your accounting application or external providers, to obtain the right results.

SplashRisk contains different types of financial structures. A financial structure in the leasing industry is for example a combination of down-payments, period of lease, residual value, client qualification (standard, start-up, no activity). The offer requested by your customer must meet all the requirements of the financing structure to be approved.

Next to the above checks are made based on payment behavior, financing policy and other financial conditions.

The workflows are fully customizable to your business processes.

Risk management is the compass for success in uncertainty.

Risk File

In case the customer was not accepted during the Simplified Risk procedure, or was filtered out even before that, we can run the Extended Risk Analysis, based on the risk file (containing the customers, endorsers, and beneficiaries) that was created for this customer

All-in-one

The Risk File was created in an intuitive way, so that all the information needed can be found in one place, together with all the calculated values (monthly rates, worst-case scenario, interest rates, shock rates, rates in case of several different depreciation conditions, etc.). Below the risk file are several different indicators to check the credit worthiness of the customer, efficiency and cashflow.

Approval Table

Based on the offer information and the risk file, an approval table is created. This approval table is directly connected to the risk file. The approval table gives an overview of the people that need to approve the offer before final acceptance. SplashRisk has the possibility to integrate this approval workflow to make the entire risk and approval process even more efficient.

Extended Risk Analysis

As the name already says, the extended risk analysis is a more complex and in-depth risk analysis. This module can be used for companies, private persons, single person companies and much more.

The extended Risk Analysis supports different types of offers which are called Frames.

For example:

Individual Frame

Here you find the information about the customer that wants to finance one or more objects.

Universal Frame

Is used for those customers that want to have a budget, against a set of conditions, to obtain several different objects of its choice.

With SplashRisk you diminish your risk and exposure dramatically to assure that you provide financing to those customers that are credit worthy, without the risk of losing your money.

Interested? Plan an orientation call today to see if SplashRisk fits your needs.

SplashDev is a Microsoft Dynamics 365 Solution Provider that helps companies achieve performance excellence and make sure their investment in software brings real, measurable results.

Home

Services

Newsletter

Signup for our newsletter to get updated information, promotion & Insight.

Copyright © 2023 SplashDev, All rights reserved. Powered by Altasoft Solutions.